This is not tax or financial advice. This is simply meant to aid you in filling out a form. Please seek help from a professional tax consultant when filling out your own W-4 form or any other tax form.

Whether you’re starting your first job, navigating a lifestyle change, or transitioning into a new job after years in the workforce, understanding the W-4 form is important for any financial situation.

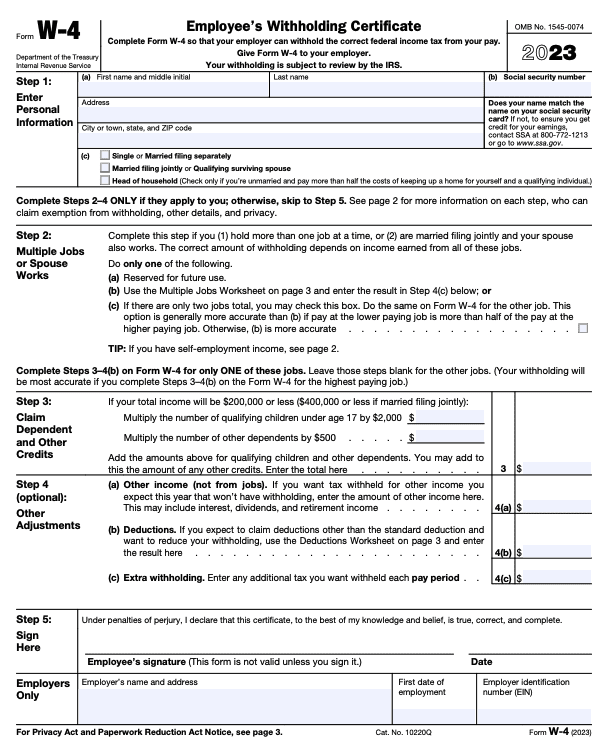

This form, also known as the employee’s withholding certificate, is the standard form employers use to obtain the necessary information to report your income to the government—and unfortunately, to take out your taxes and Social Security/Medicare tax (“FICA”), too. But unlike most tax forms, filling out a W4 isn’t actually that hard. It’s a simple one-page form with limited fields, and most can do it on their own without the help of a tax professional.

However, the form gives you a little bit of control over how your taxes are collected, so a little guidance doesn’t hurt. And that’s why—in this article—we’ll show you step-by-step W-4 instructions for the upcoming tax year.

Below we’ll break up the process into sections. Each section shows you the basics of how to fill out the tax form and ensure that you have the proper amount of money taken from your hard-earned paycheck every month, so you can avoid unwelcome surprises come tax time.

W-4 Form Basics

Think of the W-4 form as a worksheet of sorts. As you go through the list, you find the relevant tax deductions for yourself. Make sure to read each line fully and consider which deductions you’re eligible for.

When filled out properly, you’ll have the right amount of tax taken out of your paycheck. This also means a smaller tax refund—but don’t worry, this is a good thing. Instead of giving the government a free loan, you’re now able to take money that would otherwise be tied up and invest it or pay down your debts. Nice, right?

So without further ado, let’s take a look at how to properly fill out your W-4 tax form for the 2024 tax year.

How To Fill Out Your 2023 W-4 Tax Form

Before we start, grab a copy of the W-4 tax from the IRS’ website. In 2020, the IRS completed a major overhaul of the W-4 Form, so it may look different from the last time you filled it out if it’s been a few years.

Once you have a copy, start reading the guide. We’ll break the form down line-by-line and discuss how to minimize your taxes taken from each paycheck.

Step 1: Enter Personal Information

Start by filling out your personal info in Step 1, Lines (a) through (c).

Step 2: Multiple Jobs or Spouse Employment

You’ll need to complete this section if you have more than one job, or your spouse is employed and you file jointly. If neither situation applies, you can skip this step.

But if either applies, you’ll need to jump down to Page 3 of the W-4 form, and complete Step 2(b) – Multiple Jobs Worksheet. However, be aware that completing this section only helps you to better estimate your tax liability as a result of having a second job. You’ll still need to complete a W-4 form for each job you or your spouse hold.

For the moment, let’s assume either situation applies – multiple jobs or your spouse works.

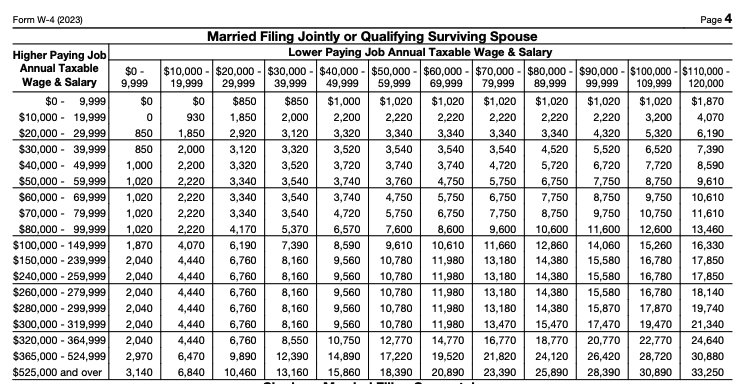

Line 1 of the multiple jobs worksheet (Two jobs) can be used if you either have two jobs or you’re married filing jointly, and your spouse also has a job. On this line, you’re going to refer to the schedule below from Page 4 that will provide you with a value to enter on this line that blends the higher paying job and a lower paying job.

Let’s assume you earn $100,000 per year, and your spouse earns $50,000. Go down the table below, on the left side of the page, and find $100,000 (which will be the $100,000 to $149,999 range). Then go to the columns to the right, and find $50,000 (which will be the $50,000 to $59,999 range).

There are separate tables for different tax filing statuses. It's important you understand the distinctions between filing as a single person, married filing separately, or head of household.

Where the two intersect on the chart, the value is $9,320. That’s the amount you’ll enter on Step (b) – Multiple Jobs Worksheet, Line 1.

To keep things simple, we’ll assume you don’t have three jobs between you and your spouse. We can skip Line 2.

Jump down to Line 3 (we’re still on the multiple jobs worksheet), and enter the number of pay periods for the year for the highest-paying job. We’ll assume 26 pay periods.

On Line 4, you’ll divide the amount on Line 1 ($9,320) by Line 3 (26 pay periods). The net result will be $358. You’ll enter that amount on Line 4 of the worksheet, but also on Line 4(c ) – Extra Withholding, on Page 1 of the W-4.

Now that we have addresed the multiple jobs issue, let’s get back to Page 1 of the W4.

Step 3: Claim Dependents

Unlike in the past, there are no longer any personal exemptions that apply to members of your household, including your children. But if you have any number of dependents, under age 17 by the end of the tax year, or other qualifying dependents, you’ll be eligible for Child Tax Credit or Credit for Other Dependents, worth up to $2,000 or $529 respectively, per dependent.

You can only claim this credit if your income is $200,000 or less for singles or $400,000 or less for married filing jointly.

Carrying our example forward, you and your spouse have a combined income of $150,000. If you have two children who will be under the age of 17 by the end of 2023, you’ll be entitled to a credit of $4,000 (2 X $2,000). You can enter $4,000 on Page 1, Line 3.

Step 4: Other Adjustments (optional)

This section is optional unless you have qualifying circumstances. You may fill out this section for any of the following three circumstances:

If you want tax withheld for other income you expect this year and won’t have withholding, enter the amount of other income here. It includes interest, dividends, and retirement income, but you may also use it to have extra withholding from a small amount of self-employment income or anything similar. For our purposes, we’ll assume there is no additional income.

Use this line if you expect the claim deductions in excess of the standard deduction and want to reduce your W-4 withholdings. You can determine that using Step 4(b) – Deductions Worksheet shown below. This calculation can be a bit tricky if you itemize deductions. You’ll have to estimate your 2024 itemized deductions, then subtract the standard deduction for your filing status. Also, you can enter an estimate for student loan interest, deductible IRA contributions, and certain other adjustments on Line 4 of the worksheet. You’ll then add those numbers together and move the total to Line 4(b) of W-4 Page 1.

Line 4(c) is a catch-all line allowing you to add any additional withholding for any other purpose.

For our example, let’s assume you’ll itemize your deductions for 2023, with an expected amount of $35,000. That will result in $10,200 ($35,000 in itemized deductions, less $24,800 for the standard deduction) being entered on Line 3 of the worksheet above. We’ll also assume both you and your spouse will make traditional IRA contributions totaling $12,000.

Line 5 of the worksheet will show $22,200, which will also be entered on Page 1, Line 4(b).

With the information we’ve calculated in our continuing example, W-4 Page 1 will look like this:

- Line 3 will show $4,000 for the Child Tax Credit.

- Line 4(b) will show $22,200 in Deductions (for itemized deductions in excess of the standard deduction, plus IRA contributions).

- Line 4(c ) will show $358.

Step 5: Sign & Date the W-4 Form

The final step – Step 5 – will require you to sign and date the form. Your employer will complete the employer information required at the bottom of the form.

And that’s all you need to do. As you can see, Form W-4 for 2021 looks a lot different than the form has in previous years. Previous editions aimed to determine a certain number of exemptions to claim – 0, 1, 2, 3, 4, etc. The object of previous editions was to determine a certain number of exemptions to claim – 0, 1, 2, 3, 4, etc. Now the object is to arrive at a dollar amount by which your income will be adjusted in calculating the necessary withholding tax.

Remember, your employer already has the income information from your primary job for calculation purposes. With the W-4, you’re really just apprising them of any adjustments that will need to be made, reflecting either upward or downward adjustments in your employment income.

Finally, I recommend you always ask a tax professional if you have questions about your W-4 form or any other tax document. A small fee upfront is better than owing the IRS fees or back taxes years down the road.

What’s Changed on Form W-4?

In 2017, the Tax Cuts and Jobs Act prompted some major revisions to the W-4 Form. Many things have stayed the same, such as the need to provide your legal name, social security number, filing status, and current address.

The biggest change is the removal of withholding allowances and mentions of tax withholding estimators. In other words, taxpayers can no longer claim withholding allowances to pay less tax. The IRS made this change to simplify the overall form when you’re filling it out for the first time.

When to Update Your W-4

Proactively updating your W-4 as you navigate life changes can ensure your employer appropriately withholds federal income tax and reduces your tax bill at the end of the year.

You may want to update your W-4 if any of the following situations come up:

- Income changes: If you start a second job, bring in new streams of income, or spend any part of the year unemployed, updating your W-4 allows you to accurately account for your new liability, especially if your tax bracket changed since last year.

- Your spouse’s income changes: If you are married and file jointly, changes in your spouse’s income may impact your combined withholding.

- Change in your filing status: If you get married or divorced throughout the tax year, your withholdings may change depending on your tax bracket.

- New baby: If your family grows and there’s a change in your number of dependents, it’s important to update your tax withholding accordingly so you can take advantage of any available credits.

How to Adjust Your Withholding

You can update your W-4 form and adjust your tax withholding by contacting your employee benefits administrator. They’ll send you a new form to fill out from scratch and you can input all your information for the current year.

If you have an annuity, retirement, or pension plan, you may also be asked to update Form W-4.

Read 1 comment or add your own

Read Comments